Indian Casino In Ione California

- Indian Casino In Ione California Elevation

- Indian Casino In Ione California Newspaper

- Indian Casino In Ione California Ione

- Indian Casino In Ione California

- Indian Casino In Ione California News Today

A site plan for the Ione Band of Miwok Indians casino in Plymouth, California. Image from Analytical Environmental Services

A site plan for the Ione Band of Miwok Indians casino in Plymouth, California. Image from Analytical Environmental ServicesThe landless Ione Band of Miwok Indians has been seeking a casino in California for at least 11 years, a process that has been contentious in the local community. But there's light at the end of the tunnel. A federal judge on Wednesday rejected two challenges to the tribe's land-into-trust application for 228 acres in Amador County. Judge Troy L. Nunley rejected a series of claims made by opponents, including the county and a national anti-Indian group. Barring further appeals, the Bureau of Indian Affairs can place the site in trust and the tribe could move forward with the long-delayed project. Plans at one point called for a 120,000 square-foot casino with a 250 room hotel and 30,000 square-foot convention facility, according to Analytical Environmental Services, which prepared the environmental impact statement for the project. There hasn't been much news about the project, though, since the BIA made its original announcement about the land-into-trust application in May 2012. Turtle Talk has posted documents from both cases, No Casino in Plymouth v. Jewell and County of Amador v. Dept. of Interior. Get the Story:

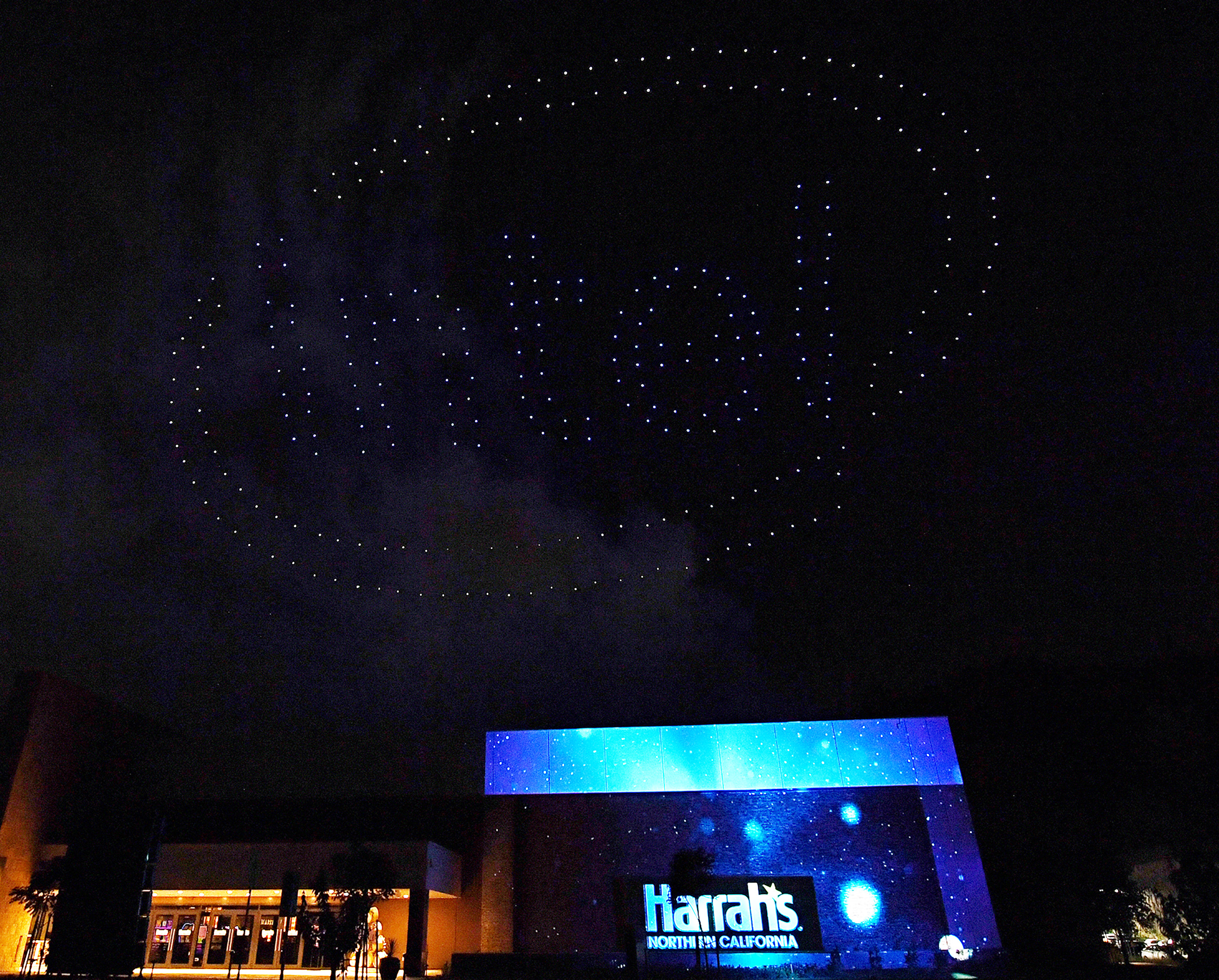

By After years of court fights and citizen efforts to halt the construction of a third casino in Amador County, the Ione Band of Miwok Indians has won federal approval for 220 acres of tribal land. Reviews on Indian Casino in Ione, CA - Harrah’s Northern California, Jackson Rancheria Casino Resort, Thunder Valley Casino Resort, Red Hawk Casino, Black Oak Casino Resort, Chicken Ranch Casino, Stones Gambling Hall, Capitol Casino, California Nations Indian Gaming Association, FLB Entertainment Center. Newsom signed a gaming compact with the Ione Band of Miwok Indians this week giving the tribe the state's final approval to build a new casino 30 miles southeast of Sacramento in Plymouth on Highway 49. The new casino will be the third tribal casino in Amador County.

Judge’s ruling clears way for Ione tribe to establish Amador casino (The Sacramento Bee 10/2) Federal Register Notice:

Land Acquisitions; Ione Band of Miwok Indians of California (May 30, 2012) Judge rejects challenges to Ione Band land-into-trust application (10/1)

Lawsuit against Ione Band casino moved to California court (03/29)

County sues DOI for approving Ione Band casino land acquisition (06/29)

Indian Casino In Ione California Elevation

Ione Band leader doesn't anticipate casino for a few more years (06/13)BIA approves land-into-trust application for Ione Band's casino (05/29)

BIA advances another land-into-trust application for casino bid (08/13)

County sues to stop Ione Band casino proposal (03/30)

Overview

In recognition of the fact that sales and purchases of tangible personal property involving American Indians and sales on Indian reservations are unique, this page is intended as a resource for information available regarding the proper application of tax for these transactions. The following regulations contain information that may be of interest:

- Regulation 1521, Construction Contractors

- Regulation 1616, Federal Areas

- Regulation 1628, Transportation Charges

- Regulation 1667, Exemption Certificates

Publication 146, Sales to American Indians and Sales in Indian Country, is primarily a guide to the proper application of California's Sales and Use Tax Law to transactions occurring in Indian country in California that involve both Indians and non-Indians. Among other things, it includes information on transactions involving construction contractors and property used in self-governance as discussed below.

If you are an Indian residing in Indian country, or you are an Indian having a construction contract performed in Indian country, you may use the following exemption certificates to provide documentation to the retailer that the sale in question is to an Indian residing in Indian country.

- CDTFA-146-RES, Exemption Certificate and Statement of Delivery in Indian Country

- CDTFA-146-CC, Construction Contract Exemption Certificate and Statement of Delivery in Indian Country

Regulation 1616, Federal Areas, provides a sales and use tax exemption for sales of property used in tribal self-governance. To qualify for this exemption, all of the following criteria must be met:

- The sale must be to a tribal government of an Indian tribe that is officially recognized by the United States,

- The tribal government's Indian tribe does not have a reservation, or the principal place where the tribal government meets to conduct tribal business is not on the reservation because the reservation does not have a building or lacks essential utility services necessary to meet and conduct tribal business,

- The property is purchased by the tribal government for use in tribal self-governance, and

- Title to the property transfers and the property is delivered to the tribal government at the principal place where the tribal government meets to conduct tribal business.

Since the tribal government may take title and possession of property outside of Indian country and still qualify as an exempt transaction under the circumstances outlined above, a retailer may verify that the address at which title to the property will transfer is valid by examining the list below. This list contains tribal governments along with the address at which they meet to conduct tribal business that are outside Indian country. Additionally, the retailer should obtain an exemption certificate from the tribal government as supporting documentation for the exempt sale. Tribal governments may use CDTFA-146-TSG, Exemption Certificate – Property Used in Tribal Self-Governance and Statement of Delivery, as part of the necessary documentation to retailers that the sale meets the criteria for the exemption as outlined above.

Tribal Government Meeting Locations outside Indian Country

List of Eligible Tribal Governments and Eligible Delivery Locations Outside Indian Country

(Current as of June 24, 2020)

Each federally-recognized Indian tribe listed below has provided information to the CDTFA indicating that its tribal government is eligible for the exemption for property used in tribal self-governance provided by Regulation 1616. The location listed under each Indian tribe’s name is the location each tribe has identified as the principal place where that tribe’s tribal government meets to conduct tribal business outside Indian country. Delivery locations that no longer qualify are also listed at the bottom of this page.

14807 Avenida Central

La Grange, CA 95329-9400

Office: 209-931-4567

Fax: 209-931-4333

570 6th Street

Williams, CA 95897

Office: 530-473-3274

410 Main Street

Greenville, CA 95947

Office: 530-284-7990

Fax: 530-284-7299

401-B Talmage Road

Ukiah, CA 95482

Office: 707-462-3682

Fax: 707-462-9183

2005 S. Escondido Blvd.

Escondido, CA 95025

Office: 760-737-7628

Fax: 760-747-8568

9252 Bush Street, Suite 3

Plymouth, CA 95669

Office: 209-245-5800

Fax: 209-245-3112

1420 Guerneville Rd., Suite 1

Santa Rosa, CA 95403

Office: 707-591-0580

Fax: 707-591-0583

705 College Avenue

Santa Rosa, CA 95404

Phone: 707-575-5586

Fax: 707-575-5506

125 Mission Ranch Blvd.

Chico, CA 95926

Office: 530-899-8922

1005 Parallel Dr.

Lakeport, CA 95453

Office: 707-263-4220

1731 Hast-Acres Dr., Suite 108

Bakersfield, CA 93309

Office 661-834-8566

9728 Kent St.

Elk Grove, CA 95624

Office: 916-683-6000

Fax: 916-683-6015

Tribal Governments and Delivery Locations Previously Approved That No Longer Qualify

4620 Shippee Lane

Stockton, CA 95212

10601 N. Escondido Pl.

Stockton, CA 95212

2133 Monte Vista Ave.

Oroville, CA 95966

Office: 530-532-9214

Fax: 530-532-1768

6400 Redwood Dr., Suite 300

Rohnert Park, CA 94928

Office: 707-566-2288

Fax: 707-566-2291

301 Industrial Ave.

Lakeport, CA 95453

9300 W. Stockton Blvd., Suite 200

Elk Grove, CA 95758

Please contact us if you believe your tribal government is eligible for the exemption discussed above and your tribal government is not on the list of eligible tribal governments. To be added to the list, please provide:

- the name of the tribe

- the name, address and telephone number of the contact person

- The address of the qualifying location, and

- An explanation why your tribal government is eligible for the exemption.

The information may be provided via email or a letter to the following address:

California Department of Tax and Fee AdministrationBusiness Taxes Committee (MIC:50)

PO Box 942879

Sacramento, CA 94279-0050

Resources

Indian Casino In Ione California Newspaper

Tribal Consultation Policy

In 2011, Governor Edmund G. Brown Jr. issued Executive Order B-10-11 requiring all State of California agencies to encourage communication and consultation with California Indian Tribes. Accordingly, the CDTFA has adopted the Tribal Consultation Policy (TCP) to memorialize its commitment to strengthening and sustaining government-to-government relationships between California Indian Tribes and the State.

Indian Casino In Ione California Ione

Tribal Liaison:

James Dahlen, Chief

Program and Compliance Bureau

(916) 552-8637

james.dahlen@cdtfa.ca.gov

Indian Casino In Ione California

Indian Casino In Ione California News Today

Deputy Liaison:

Bradley Heller, Tax Counsel IV

Legal Division

(916) 323-3091

bradley.heller@cdtfa.ca.gov